Strategic Product Compliance Services

Comprehensive product compliance for growth-stage fintechs

Compliance as a Feature

Compliance Program Development

Embed regulatory requirements directly into your product development process.

Build or enhance scalable compliance management systems (CMS) with governance, training, and reporting structures.

We partner with your product managers and engineers to translate compliance obligations into features, not afterthoughts. This approach prevents costly post-launch retrofitting and ensures your roadmap accelerates, not stalls, due to regulatory requirements.

Key Outcomes:

Minimal regulatory delays in product launches

Compliance as a feature, not a blocker

Reduced Time to Market for new offerings

Scalable Compliance

BSA/ AML Framework Development

Development and optimization of BSA/ AML programs, including risk assessments, policies, procedures, and internal controls.

We build comprehensive frameworks tailored to your business model and customer base, ensuring regulatory alignment while enabling efficient operations.

Our approach transforms compliance from a checkbox exercise into a strategic program that scales with your growth.

Key Outcomes:

Comprehensive risk-based BSA/AML programs

Tailored policies and procedures documentation

Efficient internal controls and governance structures

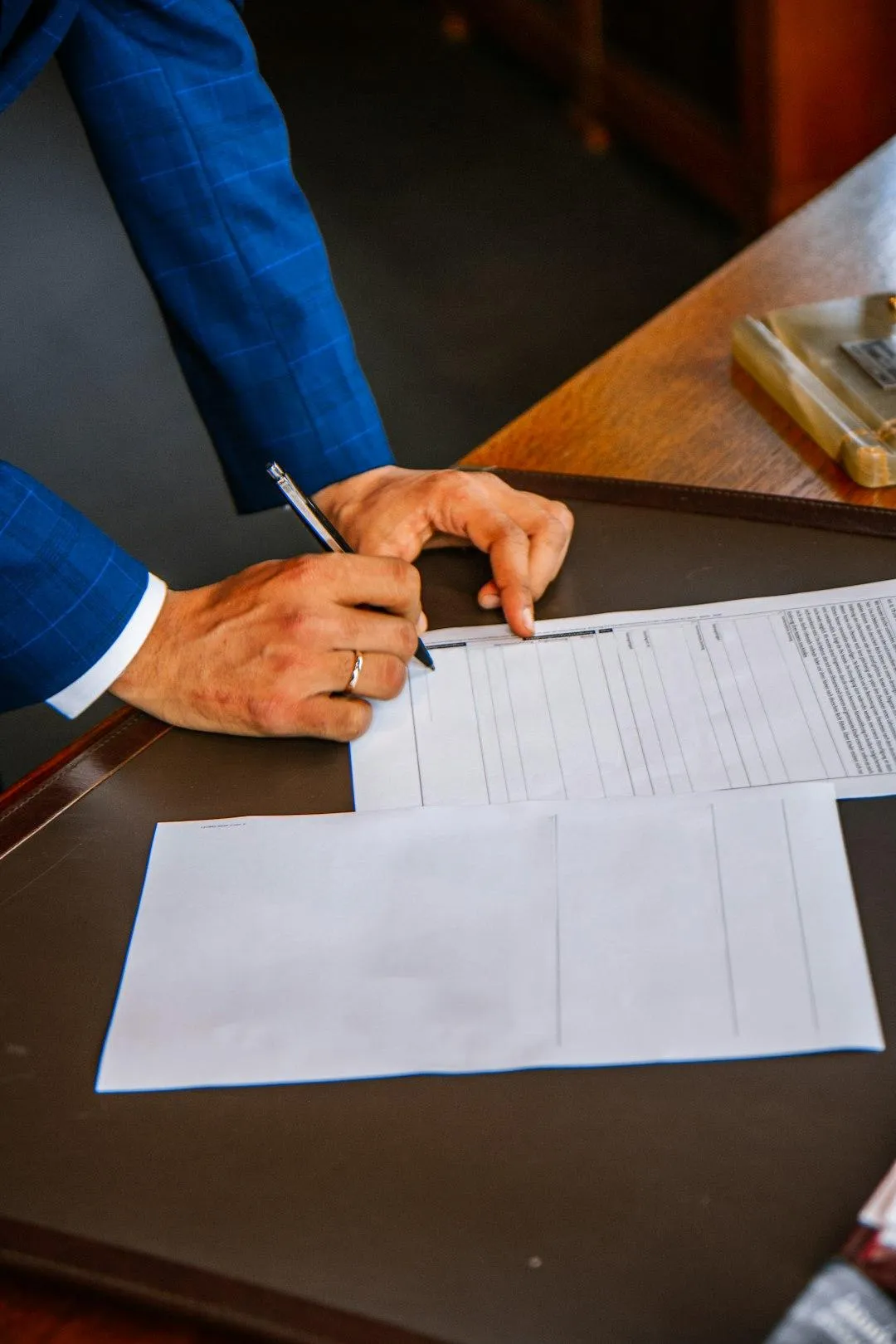

Improved Exam Outcomes

Partner Bank & 3rd Party Compliance Management

Provide your partners with everything they need to

Guidance on managing compliance expectations of sponsor banks and third-party partners including documentation, communication, and ongoing oversight.

We conduct gap analyses, remediate findings, and build examination-ready documentation that demonstrates program maturity to regulators. Our preparation ensures you're not just compliant on paper—you're operationally ready to prove it.

Key Outcomes:

Successful regulatory examination outcomes

Proactive risk identification and remediation

Examiner-ready documentation and evidence

Share Responsibility

Cross-Functional Team Alignment

Bridge the gap between compliance, product, engineering, and operations teams.

We facilitate workshops, create compliance playbooks in plain language, and establish communication frameworks that turn regulatory requirements into shared objectives. When everyone speaks the same language, compliance becomes a team sport.

Key Outcomes:

Seamless collaboration across functions

Compliance integrated into standard workflows

Reduced friction and faster decision-making

Improved Exam Outcomes

Regulatory Exam Preparation

Navigate state and federal regulatory examinations with confidence.

We conduct gap analyses, remediate findings, and build examination-ready documentation that demonstrates program maturity to regulators. Our preparation ensures you're not just compliant on paper—you're operationally ready to prove it.

Key Outcomes:

Successful regulatory examination outcomes

Proactive risk identification and remediation

Examiner-ready documentation and evidence

Share Responsibility

Transaction Monitoring & Fraud Prevention

Bridge the gap between compliance, product, engineering, and operations teams.

We facilitate workshops, create compliance playbooks in plain language, and establish communication frameworks that turn regulatory requirements into shared objectives. When everyone speaks the same language, compliance becomes a team sport.

Key Outcomes:

Seamless collaboration across functions

Compliance integrated into standard workflows

Reduced friction and faster decision-making

Why Weave Compliance?

Frequently Asked Questions

Clear answers to help you make confident product compliance decisions.

What types of fintech companies do you work with?

We specialize in growth-stage fintech companies (Series A-C) that are scaling products across payment processing, lending, digital banking, and embedded finance. Our clients typically have 20-500 employees and are expanding into new states, launching new products, or preparing for regulatory examinations. We're the best fit for companies that want compliance to be a strategic enabler, not a blocker.

How is your approach different from traditional compliance consulting?

Traditional consultants create policies and frameworks after your product is built, "bolt-on compliance," as we call it. We take the opposite approach: embedding compliance directly into your product development process from day one.

We work alongside your product managers and engineers to translate regulatory requirements into features, preventing costly retrofitting and ensuring compliance accelerates rather than delays your roadmap.

What's included in a typical engagement?

Most engagements follow a phased approach:

(1) Compliance Framework Assessment – We conduct gap analysis and risk assessment against regulatory requirements;

(2) Product Integration & Control Design – We partner with your teams to embed compliance into product features and workflows;

(3) Regulatory & Strategy Support – We prepare you for examinations and help position your compliance program as a strategic asset to investors. Projects typically run 6-12 months with clear deliverables at each phase.

Do you provide ongoing compliance support, or just project-based work?

Both. Many clients start with a project-based engagement to establish foundations, then transition to a retainer relationship for ongoing support as they scale. We can act as your fractional Chief Compliance Officer, providing strategic guidance, regulatory monitoring, and hands-on support without the cost of a full-time executive hire.

How quickly can we get started?

We can typically begin within 5-7 business days of our initial consultation.

We'll schedule a strategy session to understand your current state, immediate needs, and growth objectives. From there, we'll provide a clear roadmap with timelines, deliverables, and investment requirements.

If you're facing an urgent regulatory examination or product launch deadline, we can often accelerate the timeline.

What results can we expect?

Our clients typically see:

1. Significant reduction in manual compliance review time through tailored monitoring frameworks;

2. Minimal regulatory delays in product launches when compliance is embedded early;

3. Successful regulatory examination outcomes with minimal findings;

4. Enhanced investor confidence, with compliance cited as a strength rather than a concern.

Most importantly, you'll have a compliance program that scales with your business growth rather than constraining it.

Get Started

Ready to make compliance your competitive advantage?

Let’s create a bespoke compliance plan that makes your growth compliant and achievable.

COMPANY

LEGAL

SOCIALS

Copyright 2026. Weave Compliance. Site by athenai. All Rights Reserved.